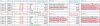

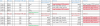

Please check chart attached as table form is not proper in post section.

So, the markets bounced back. If you see what have the FII,DII and Professionals done then it makes sense as there is a reduction in short positions in Index. There is stark difference in FII/DII vision and Client positions in Index. FII/DII have a net long position and Clients have a net short position. Success to trading in Indian market is to be with FII's and not majority retail public.

Invite healthy discussion on this

So, the markets bounced back. If you see what have the FII,DII and Professionals done then it makes sense as there is a reduction in short positions in Index. There is stark difference in FII/DII vision and Client positions in Index. FII/DII have a net long position and Clients have a net short position. Success to trading in Indian market is to be with FII's and not majority retail public.

Invite healthy discussion on this

Last edited: