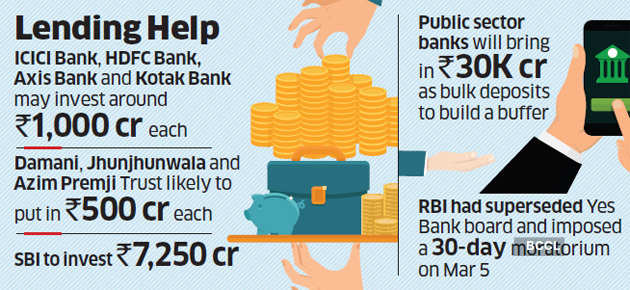

Seven investors join SBI to put over Rs 12,000 cr into Yes Bank; Prashant Kumar proposed as new CEO

Government-owned State Bank of India will be joined by private lenders

ICICI Bank,

HDFC Bank,

Axis Bankand

Kotak Mahindra Bank as well as investors

Radhakishan Damani,

Rakesh Jhunjhunwala and the

Azim Premji Trust in the rescue plan for

Yes Bank to invest more than Rs 12,000 crore, said three people aware of the development. As per the proposal sent to the Reserve Bank of India (RBI), these investors will together hold more than 49%, with SBI holding the largest share at 45%, they said.

SBI has also recommended appointing Yes Bank administrator

Prashant Kumar as the new CEO of the bank.

Public sector banks will bring in Rs 30,000 crore as bulk deposits, as per the proposal. “The final plan has been sent to the RBI, these need not be final set of investors, as of now. In all, apart from SBI there are seven other investors,” said an official aware of the details. “All the investors are local and their collective share is slightly more than what SBI is investing on its own. They are investing in phases and it is possible that they will invest more in the future or foreign funds will join in later.”

In an exchange filing on Thursday afternoon, SBI had said it will invest Rs 7,250 crore in Yes Bank for a 49% stake, in line with a rescue plan drawn up by the Reserve Bank of India (RBI).

“The executive committee of (SBI’s) central board has approved purchase of 725 crore shares in Yes Bank Ltd at a price of Rs 10 per share subject to all regulatory approvals,” SBI said in an exchange announcement. “Our shareholding in Yes Bank Ltd. will remain within 49% of the paid-up capital of Yes Bank.”

Sources indicated that the private sector banks could chip in with around Rs 1,000 crore each and the high net worth investors could contribute Rs 500 crore each.

AT1 Bondholders Submit Formal Proposal

“All the four private sector banks will hold not more than 5% each. There are other investors also which will invest and together these investors will hold slightly more equity than SBI,” said a person familiar with the matter.

The central bank had unveiled the SBI-led proposal public on March 6, a day after it superseded the board and imposed a 30-day moratorium.

ET reported March 12 that SBI and other investors are likely to arrange equity capital of Rs 20,000 crore. Public sector banks will also likely build a buffer through Rs 30,000 crore of bulk deposit and certificate of deposits to stabilise the bank in case of withdrawals and fund transfers once the moratorium is lifted.

The RBI had named Kumar as Yes Bank administrator in its March 5 announcement. He’s a former deputy managing director and chief financial officer of SBl.

Separately, additional tier 1(AT1) bondholders submitted a formal proposal to the central bank on Thursday. They want 1.7 billion shares worth Rs 1,700 crore in lieu of the bonds held by them, which would salvage 20% of their value. The RBI is yet to decide on this. Under the March 6 plan, about Rs 8,500 crore of AT1 bonds are to be written down to zero. Mutual fund companies such as Nippon, Kotak and Franklin, pension funds, insurance firms and the likes of Reliance Industries and Barclays Bank are among those that will lose money.

The bondholders are seeking to move court against this.

“If the proposal is accepted, AT1 bondholders would not pursue any legal recourse and the writ petition against the RBI will be withdrawn,” according to the proposal submitted to the RBI. ET has seen a copy of this.

Read more at:

https://economictimes.indiatimes.co...ofinterest&utm_medium=text&utm_campaign=cppst

With Rs 1,000 Crore, ICICI Bank To Own 5% Of Yes Bank

ICICI said it will buy 100 crore shares of Yes Bank at Rs 10 per share and hold about a 5 per cent stake.