Fund managers' bets: Top 10 large, mid and small-cap stocks that MFs bought in October

MF industry assets grew to Rs 22.2 lakh crore on the back of improved inflows into equity-oriented and liquid funds

Despite the significant volatility in October, equity inflows continued to witness a steady uptrend and was at an eight-month high in October, said a report.

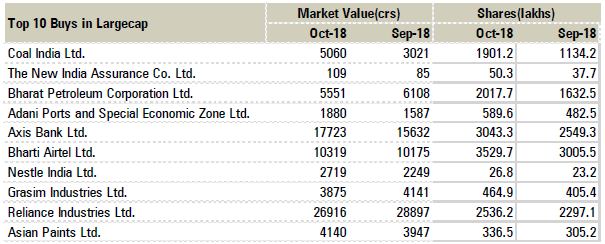

Specifically, top 10 large-cap stocks which fund managers bought in October include names like Coal India, New India Assurance, BPCL, Adani Ports, Axis Bank, Bharti Airtel, Nestle India, Grasim Industries, RIL, and Asian Paints witnessed highest buying during October 2018, said the ICICIdirect report.

In midcaps, stocks like Motilal Oswal Financial Services, Avanti Feeds, ACC, HEG, NBCC, Reliance Capital, SJVN, KRBL, Future Retail, and LIC Housing Finance witnessed highest buying during October 2018.

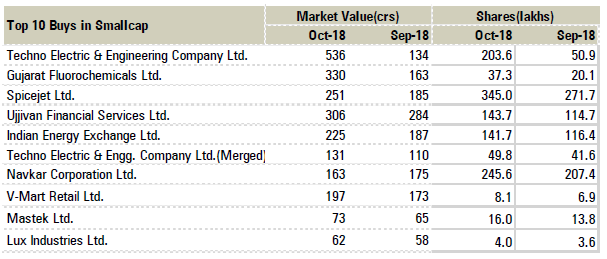

In small caps, stocks like Techno Electric, Gujarat Fluoro, Spice Jet, Ujjivan Financial Services, Indian Energy Exchange, Navkar Corporation, V-Mart, Mastek, and Lux Industries found favour among investors in October.

https://www.moneycontrol.com/news/b...tocks-that-mfs-bought-in-october-3169411.html