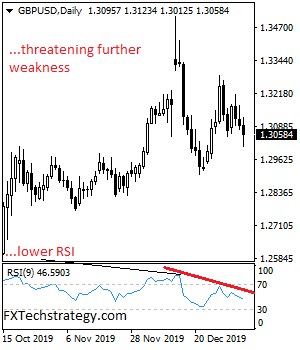

GBPUSD Sees Price Extension With Eyes On 1.2900 Zone

GBPUSD with the pair extending its strength, more price gain is expected in the days ahead. Support lies at 1.2800 area with a break below that level turning attention to the 1.2750 level. Further down, support lies at the 1.2700 level where a violation will shift focus to the 1.2650 level. Below here will open the door towards the 1.2600 level. On the upside, resistance is located at the 1.2900 with a break above there allowing for morel strength to build up towards the 1.2950 level. Further out, resistance stands at the 1.3000 level followed by the 1.3050 level. On the whole, GBPUSD retains its upside pressure as it eyes further strength.

GBPUSD with the pair extending its strength, more price gain is expected in the days ahead. Support lies at 1.2800 area with a break below that level turning attention to the 1.2750 level. Further down, support lies at the 1.2700 level where a violation will shift focus to the 1.2650 level. Below here will open the door towards the 1.2600 level. On the upside, resistance is located at the 1.2900 with a break above there allowing for morel strength to build up towards the 1.2950 level. Further out, resistance stands at the 1.3000 level followed by the 1.3050 level. On the whole, GBPUSD retains its upside pressure as it eyes further strength.