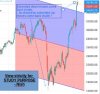

Got good opportunity to short BN.

Chart shows 5/15EMA break-down on 10m , quick 300 pts from 31380 to 31090 ( adjusted ) !

If support of 30850 not broken, may we see a Gap-up on 27Jan ? .. Really NOT sure since volatility rules currently and IVix is up 3 % at 23 !

View strictly for STUDY PURPOSE !

Chart shows 5/15EMA break-down on 10m , quick 300 pts from 31380 to 31090 ( adjusted ) !

If support of 30850 not broken, may we see a Gap-up on 27Jan ? .. Really NOT sure since volatility rules currently and IVix is up 3 % at 23 !

View strictly for STUDY PURPOSE !

Attachments

-

66.9 KB Views: 24