@Happy_Singh I am sorry I am tagging you here since I am unable to PM you. I was hoping to get your advice on an AFL. Can I please request your guidance? Thank you.

Afin's trading diary

- Thread starter afin

- Start date

The growing threat of climate change in India

https://www.livemint.com/news/india/the-growing-threat-of-climate-change-in-india-1563716968468.html

And people assume I am being negative when I point that out!

https://www.livemint.com/news/india/the-growing-threat-of-climate-change-in-india-1563716968468.html

And people assume I am being negative when I point that out!

After blowing accounts and using so called dicretionary systems...I lost my peace of mind totally. Last year during the same time, after learning about many many more technical analysis tools including different MAs and MA crossovers, I adopted a system that was still discretionary. I was still getting whooped.

That was when I started to do meditation and cut down the discretionary part ruthlessly. It then occurred to me that the ground beneath my feet is not shaky anymore and I could stand and see properly and walk properly again before I can start running. Go completely mechanical if you want long term sustainability. Have a system in place even if it gives you a 30% to 40% only strike rate. Long term wise it will help you immensely.

I have done the following. I would suggest the same for you too. I hope they help you too:

That was when I started to do meditation and cut down the discretionary part ruthlessly. It then occurred to me that the ground beneath my feet is not shaky anymore and I could stand and see properly and walk properly again before I can start running. Go completely mechanical if you want long term sustainability. Have a system in place even if it gives you a 30% to 40% only strike rate. Long term wise it will help you immensely.

I have done the following. I would suggest the same for you too. I hope they help you too:

- Zero in on a 2 to 3 rule based trading system- for each of your systems - i.e, intraday/ swing/ positional. My intraday system has only 2 rules. My swing system also has 2 rules only.

- If you are doing intraday, do not have more than 1 open position at any time. Remember that we are not Superman or Shaktimaan that we can multi-task. I was a cognitive neuroscience researcher & trust me when I say that multi-tasking is a myth and the greatest scam perpetrated upon us. Humans cannot multi-task. We can only do things sequentially. You might be a freak of nature and get things right initially or somewhere in between but you cannot get things right all the time if you multi-task. Still don't believe me? Study the empirical research for yourself.

- Be very strict with your entries and exits and do not have stupid things like early entry and early exits in place. There are no early or late exits. Just exits and entries. You either enter or you do not. Do not be in between.

- Maintain a trade journal and be brutally honest. Do not write any qualitative detail in it. The journal should be simple and should speak for itself.

- On input of @XRAY27 : (daily read before market time)"I have made all the hard working making and testing a system ,now my task is the follow it,& will never compare my result with other person"

After blowing accounts and using so called dicretionary systems...I lost my peace of mind totally. Last year during the same time, after learning about many many more technical analysis tools including different MAs and MA crossovers, I adopted a system that was still discretionary. I was still getting whooped.

That was when I started to do meditation and cut down the discretionary part ruthlessly. It then occurred to me that the ground beneath my feet is not shaky anymore and I could stand and see properly and walk properly again before I can start running. Go completely mechanical if you want long term sustainability. Have a system in place even if it gives you a 30% to 40% only strike rate. Long term wise it will help you immensely.

I have done the following. I would suggest the same for you too. I hope they help you too:

That was when I started to do meditation and cut down the discretionary part ruthlessly. It then occurred to me that the ground beneath my feet is not shaky anymore and I could stand and see properly and walk properly again before I can start running. Go completely mechanical if you want long term sustainability. Have a system in place even if it gives you a 30% to 40% only strike rate. Long term wise it will help you immensely.

I have done the following. I would suggest the same for you too. I hope they help you too:

- Zero in on a 2 to 3 rule based trading system- for each of your systems - i.e, intraday/ swing/ positional. My intraday system has only 2 rules. My swing system also has 2 rules only.

- If you are doing intraday, do not have more than 1 open position at any time. Remember that we are not Superman or Shaktimaan - very interesting read, i am also none of the 2 or 4 BUT if somebody has position size, entry,exit and probable tgts before the mkt open and only work during the mkt is to punch orders and put sl (CO/BO) and once trade triggered, only thing is to trail the sl and not not doing any short of analysis. now here one can have 3-4-5 (whatever manageable as per person's ability) do you still think its multi tasking and very difficult to do in the long run? the reason i am asking ( as you are qualified person in this field) this is, I am doing this for past couple of months in stocks intra trading and felling absolutely stress free during trading hours that we can multi-task. I was a cognitive neuroscience researcher & trust me when I say that multi-tasking is a myth and the greatest scam perpetrated upon us. Humans cannot multi-task. We can only do things sequentially. You might be a freak of nature and get things right initially or somewhere in between but you cannot get things right all the time if you multi-task. Still don't believe me? Study the empirical research for yourself.

- Be very strict with your entries and exits and do not have stupid things like early entry and early exits in place. There are no early or late exits. Just exits and entries. You either enter or you do not. Do not be in between.

- Maintain a trade journal and be brutally honest. Do not write any qualitative detail in it. The journal should be simple and should speak for itself.

- On input of @XRAY27 : (daily read before market time)"I have made all the hard working making and testing a system ,now my task is the follow it,& will never compare my result with other person"

as long as you feel stress free bhai. My feel is that at the moment, it becomes quite difficult to handle more than 1 open position at any given time on intraday. For me too personally I cannot handle more than 1 open intraday position.

As long as one sticks to the method mechanically, I think at the most 2 open positions can be handled. It becomes routinized over a point in time, and one can do it with attaching themselves too much to it. So in short, I think one could 2 open intraday positions but beyond that becomes a difficult thing to sustain from a long term sustainability point of view. But having said this, there will always be some outliers who can do 3 open positions and still be successful also. But we are taking about 1 in 10,000 cases - low probability cases.

As long as one sticks to the method mechanically, I think at the most 2 open positions can be handled. It becomes routinized over a point in time, and one can do it with attaching themselves too much to it. So in short, I think one could 2 open intraday positions but beyond that becomes a difficult thing to sustain from a long term sustainability point of view. But having said this, there will always be some outliers who can do 3 open positions and still be successful also. But we are taking about 1 in 10,000 cases - low probability cases.

as long as you feel stress free bhai. My feel is that at the moment, it becomes quite difficult to handle more than 1 open position at any given time on intraday. For me too personally I cannot handle more than 1 open intraday position.

As long as one sticks to the method mechanically, I think at the most 2 open positions can be handled. It becomes routinized over a point in time, and one can do it with attaching themselves too much to it. So in short, I think one could 2 open intraday positions but beyond that becomes a difficult thing to sustain from a long term sustainability point of view. But having said this, there will always be some outliers who can do 3 open positions and still be successful also. But we are taking about 1 in 10,000 cases - low probability cases.

As long as one sticks to the method mechanically, I think at the most 2 open positions can be handled. It becomes routinized over a point in time, and one can do it with attaching themselves too much to it. So in short, I think one could 2 open intraday positions but beyond that becomes a difficult thing to sustain from a long term sustainability point of view. But having said this, there will always be some outliers who can do 3 open positions and still be successful also. But we are taking about 1 in 10,000 cases - low probability cases.

Any halfwit who has a basic comprehension of language skills would come to a realization that things aren't well with our planet's health

. Yet I am called a merchant of doom

. Yet I am called a merchant of doom

. Greatest joke!

. Greatest joke!

I have been working with these issues for far too long a time. I know what I speak. Just google up the latest Oceans and Cryosphere report by the IPCC and you will understand it

in fact any one with a 7th class knowledge and understanding of science will know understand that. If not may the Gods above show mercy on your poor souls

in fact any one with a 7th class knowledge and understanding of science will know understand that. If not may the Gods above show mercy on your poor souls

It is a monumental time we live. So I was just saying that our trading decisions should be based on that. It is called de-risking or managing risk

and it is no rocket science.

and it is no rocket science.

https://www.sciencealert.com/un-rep...dy-here-for-world-s-oceans-and-frozen-regions

UN Report on Earth's Oceans Confirms The Catastrophe Is Already Unfolding Around Us

So

and going by that logic everyone who is advocating for some action or the other on climate change is a peddler of doom, merchant of doom and a negative, pessimistic fellow

and that includes our hon'ble PM also who has been directing and giving such visionary direction in the form of Jal Shakti Abhiyaan etc etc to avoid the gloom.

and that includes our hon'ble PM also who has been directing and giving such visionary direction in the form of Jal Shakti Abhiyaan etc etc to avoid the gloom.

Lol

case rested!

case rested!

As a parting shot, I will leave you with the following video. Just because I am for the Environment, doesn't make me a negative person. If that is the yardstick used, then the revered Sadhguru must also be a very negative minded person for advocating this.

. Yet I am called a merchant of doom

. Yet I am called a merchant of doom

. Greatest joke!

. Greatest joke!

I have been working with these issues for far too long a time. I know what I speak. Just google up the latest Oceans and Cryosphere report by the IPCC and you will understand it

in fact any one with a 7th class knowledge and understanding of science will know understand that. If not may the Gods above show mercy on your poor souls

in fact any one with a 7th class knowledge and understanding of science will know understand that. If not may the Gods above show mercy on your poor souls

It is a monumental time we live. So I was just saying that our trading decisions should be based on that. It is called de-risking or managing risk

and it is no rocket science.

and it is no rocket science.https://www.sciencealert.com/un-rep...dy-here-for-world-s-oceans-and-frozen-regions

UN Report on Earth's Oceans Confirms The Catastrophe Is Already Unfolding Around Us

So

and going by that logic everyone who is advocating for some action or the other on climate change is a peddler of doom, merchant of doom and a negative, pessimistic fellow

and that includes our hon'ble PM also who has been directing and giving such visionary direction in the form of Jal Shakti Abhiyaan etc etc to avoid the gloom.

and that includes our hon'ble PM also who has been directing and giving such visionary direction in the form of Jal Shakti Abhiyaan etc etc to avoid the gloom.Lol

case rested!

case rested!As a parting shot, I will leave you with the following video. Just because I am for the Environment, doesn't make me a negative person. If that is the yardstick used, then the revered Sadhguru must also be a very negative minded person for advocating this.

Last edited:

Slowing economic growth has been a concern all over the world on the back of ongoing trade wars, protectionism and geopolitical tensions. The International Monetary Fund and the World Trade Organisation have warned that these issues pose further downside risks to global growth. India, the world's fastest-growing economy, is also struggling to maintain the pace, with GDP growth slowing to a six-year low of 5 percent during the April-June period.

However, global trends reflect only a fraction of the slowdown in India's economy, argued JPMorgan emerging markets economists Sajjid Chinoy and Toshi Jain. The real culprit is consumption.

"While export growth has slowed to less than 6 percent in 3Q19 from double-digit growth in previous quarters, the percentage-point contribution of exports to slowing headline GDP growth across the latest two quarters—at 0.8 percentage point in 3Q19—was less than one-third of the downshift caused by slowing private consumption growth," they said in a research note dated September 27. Below are the vital points of their research note:

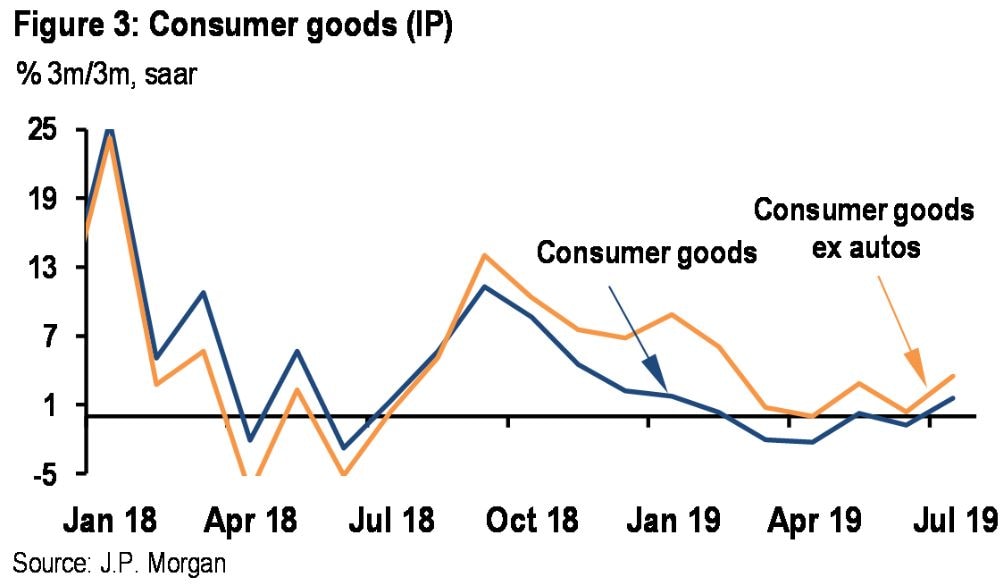

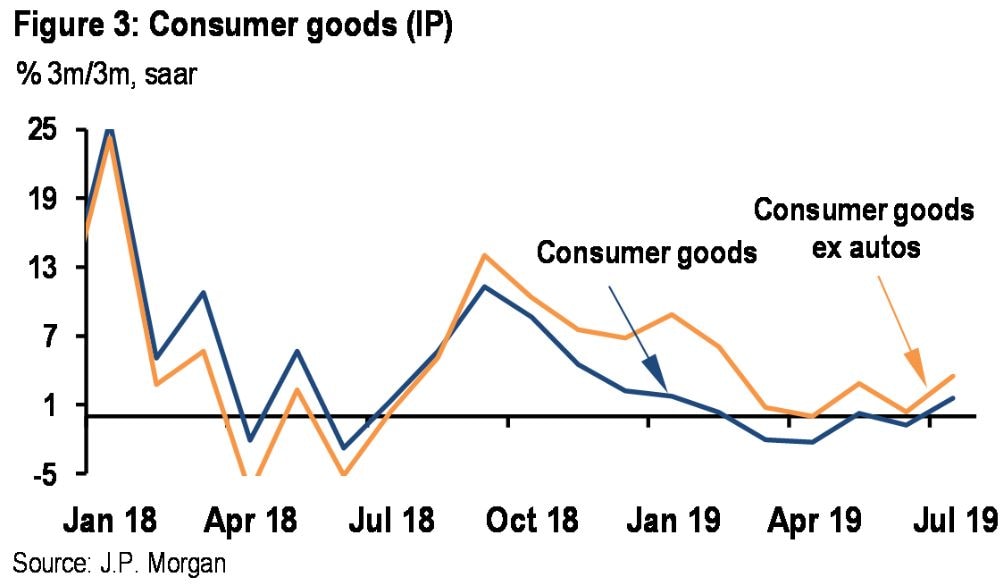

Consumption slowdown

Private consumption has been a key contributor to India’s growth over the last four years, with an average growth of around 7 percent to 8 percent since 2015, according to JPMorgan. The consumption growth slowed to a five-year low of 3.1 percent in 3Q19. While the sudden downshift may have been a surprise, the direction shouldn’t have been as the consumption has been slowing for the last year, noted the report.

The auto sector faced a severe slowdown in the last one year, with sales falling over decade lows, due to a rise in the goods and service tax and higher costs of registration and insurance. A liquidity crunch and rising bad loans in the non-banking financial companies have also squeezed credit availability to auto dealers.

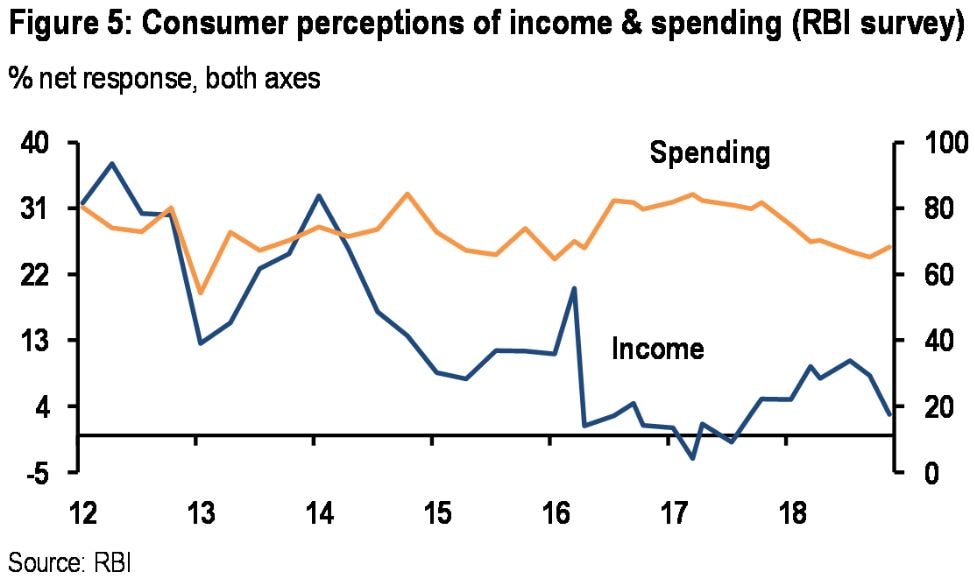

Income growth

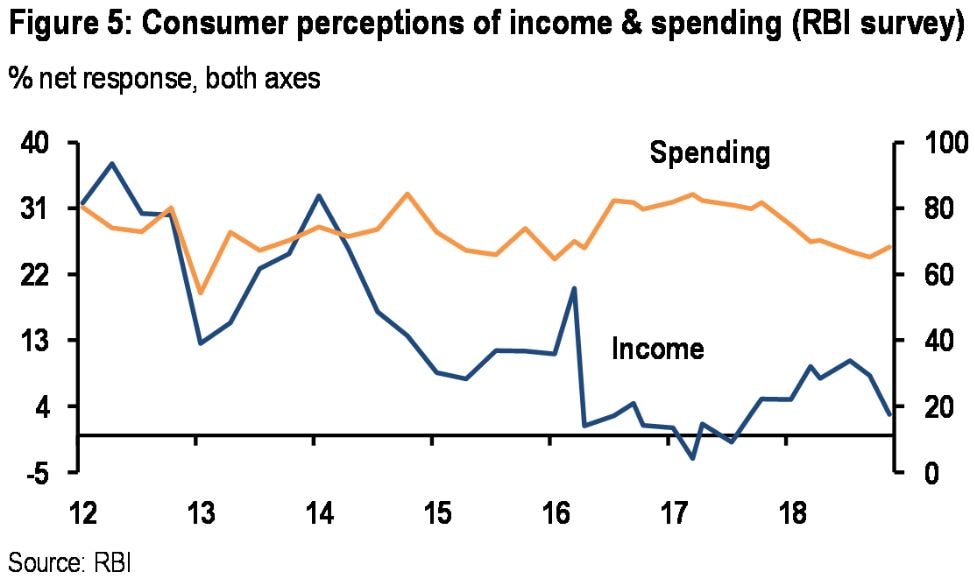

Consumer debt also has been climbing, with Credit Bureau data suggesting that “individual debt” has risen by 10 percentage points of GDP in just four years, pointed out the report. The latest RBI Consumer Household Survey reveals that income perceptions have continued to fall but spending perceptions haven’t. In other words, JPMorgan said, income growth has not kept pace with consumption.

"These dynamics are sustainable in good times. However, when the economy is hit by a negative shock followed by a sustained slowdown, households may begin to mark down future income expectations. If so, households could begin tightening their belts by slowing the pace of debt accumulation or increasing precautionary savings," noted the economists in the report.

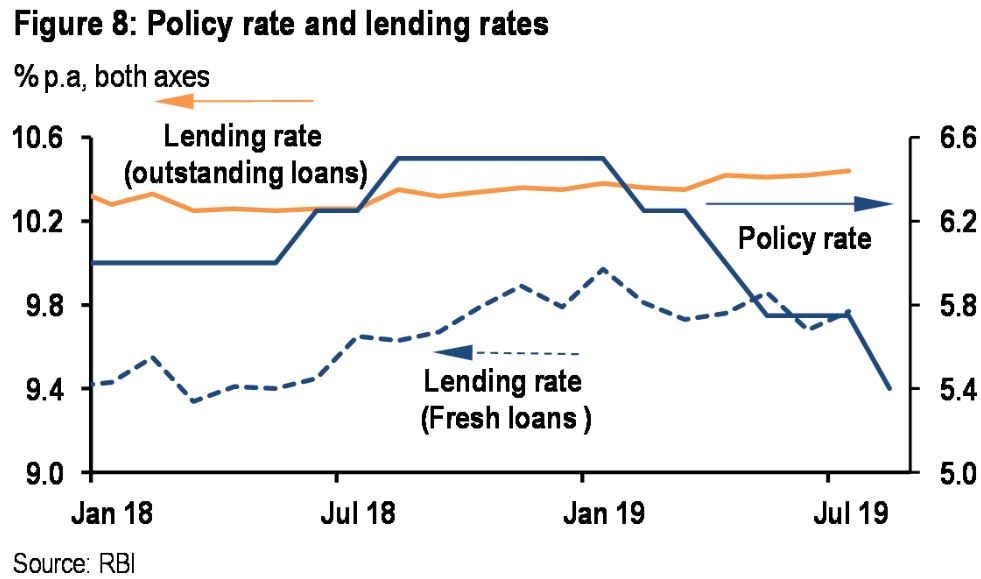

Monetary transmission

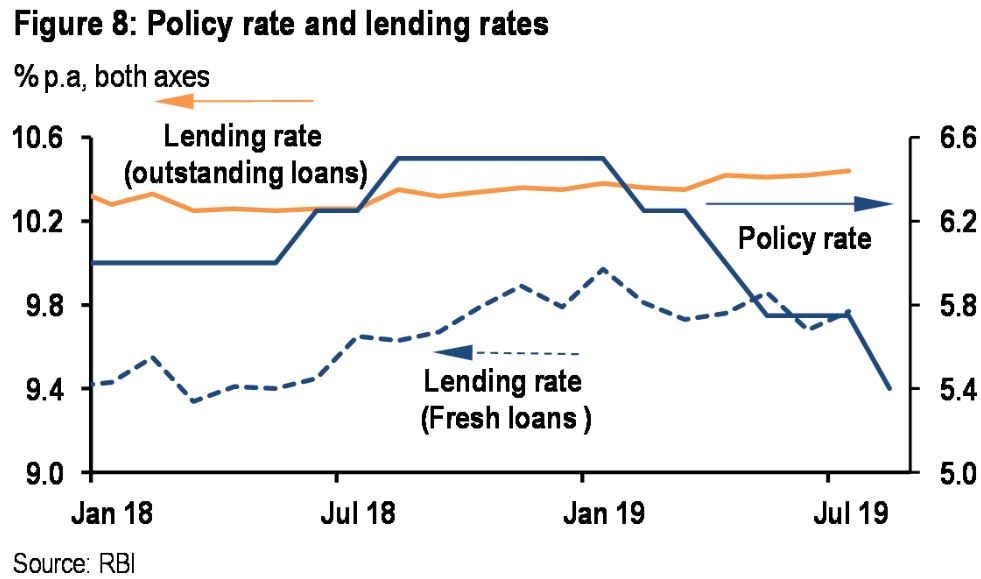

Despite the Reserve Bank of India cutting rates by 110 basis points in 2019 and inter-bank liquidity in a meaningful surplus, bank lending rates showed very limited transmission from the RBI policy rates, noted the report.

Financial intermediaries also have been plagued by risk aversion and with rates on small savings much higher than bank deposit rates, it is hard for banks to cut deposit rates and, therefore, lending rates, said the economists.

Fiscal pressure

Finance minister Nirmala Sitharaman has reduced the corporate tax rate on domestic companies by at least 5 percentage points, which could result in a revenue loss of Rs 1.45 lakh crore per year. The tax cuts are expected to increase the consolidated fiscal deficit by 0.5 percent to 0.7 percent of GDP, according to JPMorgan.

Along with falling tax collections due to slowing economic activity, the tax cuts meaningfully increase the likelihood of the government missing its 3.3 percent of GDP deficit target, noted the report.

JPMorgan expects the government's fiscal slippage could be less than the 0.5 percent of GDP. "We believe the Center will limit the slippage potentially through a combination of expenditure cuts, and pushing some subsidies off the balance sheet—like last year—to assuage bond market concerns," it said.

Growth forecast

JPMorgan believes that the direct near-term impact on growth from the tax cuts is expected to be limited. "The corporate tax cut should be thought of as boosting the supply side at a time when much of the slowdown is on account of weak demand. Therefore, how much investment firms will undertake in the near term in response to the tax cut remains to be seen," noted the report.

JPMorgan said there were meaningful downside risks to its previous growth forecast of 6.4 percent, with growth on track to print closer to 6 percent. "After the tax cuts, however, the markdown to growth is more modest, to 6.2 percent in 2019-20," it said.

However, global trends reflect only a fraction of the slowdown in India's economy, argued JPMorgan emerging markets economists Sajjid Chinoy and Toshi Jain. The real culprit is consumption.

"While export growth has slowed to less than 6 percent in 3Q19 from double-digit growth in previous quarters, the percentage-point contribution of exports to slowing headline GDP growth across the latest two quarters—at 0.8 percentage point in 3Q19—was less than one-third of the downshift caused by slowing private consumption growth," they said in a research note dated September 27. Below are the vital points of their research note:

Consumption slowdown

Private consumption has been a key contributor to India’s growth over the last four years, with an average growth of around 7 percent to 8 percent since 2015, according to JPMorgan. The consumption growth slowed to a five-year low of 3.1 percent in 3Q19. While the sudden downshift may have been a surprise, the direction shouldn’t have been as the consumption has been slowing for the last year, noted the report.

The auto sector faced a severe slowdown in the last one year, with sales falling over decade lows, due to a rise in the goods and service tax and higher costs of registration and insurance. A liquidity crunch and rising bad loans in the non-banking financial companies have also squeezed credit availability to auto dealers.

Income growth

Consumer debt also has been climbing, with Credit Bureau data suggesting that “individual debt” has risen by 10 percentage points of GDP in just four years, pointed out the report. The latest RBI Consumer Household Survey reveals that income perceptions have continued to fall but spending perceptions haven’t. In other words, JPMorgan said, income growth has not kept pace with consumption.

"These dynamics are sustainable in good times. However, when the economy is hit by a negative shock followed by a sustained slowdown, households may begin to mark down future income expectations. If so, households could begin tightening their belts by slowing the pace of debt accumulation or increasing precautionary savings," noted the economists in the report.

Monetary transmission

Despite the Reserve Bank of India cutting rates by 110 basis points in 2019 and inter-bank liquidity in a meaningful surplus, bank lending rates showed very limited transmission from the RBI policy rates, noted the report.

Financial intermediaries also have been plagued by risk aversion and with rates on small savings much higher than bank deposit rates, it is hard for banks to cut deposit rates and, therefore, lending rates, said the economists.

Fiscal pressure

Finance minister Nirmala Sitharaman has reduced the corporate tax rate on domestic companies by at least 5 percentage points, which could result in a revenue loss of Rs 1.45 lakh crore per year. The tax cuts are expected to increase the consolidated fiscal deficit by 0.5 percent to 0.7 percent of GDP, according to JPMorgan.

Along with falling tax collections due to slowing economic activity, the tax cuts meaningfully increase the likelihood of the government missing its 3.3 percent of GDP deficit target, noted the report.

JPMorgan expects the government's fiscal slippage could be less than the 0.5 percent of GDP. "We believe the Center will limit the slippage potentially through a combination of expenditure cuts, and pushing some subsidies off the balance sheet—like last year—to assuage bond market concerns," it said.

Growth forecast

JPMorgan believes that the direct near-term impact on growth from the tax cuts is expected to be limited. "The corporate tax cut should be thought of as boosting the supply side at a time when much of the slowdown is on account of weak demand. Therefore, how much investment firms will undertake in the near term in response to the tax cut remains to be seen," noted the report.

JPMorgan said there were meaningful downside risks to its previous growth forecast of 6.4 percent, with growth on track to print closer to 6 percent. "After the tax cuts, however, the markdown to growth is more modest, to 6.2 percent in 2019-20," it said.

China Won’t Save the World Economy This Time

U.S. recession indicators are growing stronger and there's one bigger-than-usual reason why the world should be worried: China isn't coming to the rescue this time.

In the past week alone, a gauge of U.S. manufacturing unexpectedly fell to its weakest reading in a decade and payrolls at private companies grew less than forecast. Economists are starting to wonder whether the U.S. has approached so-called stall speed, the slowest pace of growth without careening into a recession. The International Monetary Fund, meanwhile, will likely downgrade global growth estimates this month.

One of the engines that drove a global economic recovery after the last two downdrafts in America – the relatively shallow one in 2001 and the catastrophe that began in 2007 – was China. As the financial crisis escalated, Beijing opened a floodgate of credit and cut interest rates, which stoked demand for everything from Australian coal to German cars.

We’re unlikely to see anything like that this time. Beijing has shown little appetite for another round of massive fiscal stimulus as it atones for the profligacy of the last decade, which left a massive buildup of debt and fueled asset bubbles.

While Chinese authorities have been juicing the economy the past year, they have been very careful about how they go about it. Economists keep predicting cuts in the benchmark interest rate; but those haven't been forthcoming, as my Bloomberg Opinion colleague Shuli Ren wrote recently. The People's Bank of China has preferred trims to lenders' reserve requirements, as officials focus on the best way to channel credit to certain sectors of the business world. Open-slather easing, it isn’t.

Getting All Nostalgic

China's growth is dramatically slower these days

Source: National Bureau of Statistics

That doesn't augur particularly well for the prospects of a global recovery. The financial crisis saw the world's most consequential central banks coordinate rate cuts, with China's participation. Beijing’s involvement made China a serious player in the global monetary order.

How likely is it that the PBOC will happily sign off on something with the Fed once again? With President Donald Trump sitting in the White House, not very. Then again, Trump has already likened Federal Reserve Chairman Jerome Powell to Chinese President Xi Jinping. Desperation has been known to make odd bedfellows in pursuit of shared short-term goals.

The good news is that any steps China does take will have ripple effects given its sheer size. Gross domestic product is now about $14 trillion, compared with barely more than $1 trillion in 2001 and about $4 trillion in 2007. Chinese firms continue to plow investment into neighboring countries and Beijing-funded lenders like the Asian Infrastructure Investment Bank may well step up to provide cash to struggling economies.

Let's keep things in perspective, though. China is now recording quarterly economic growth of about 6%, not the 15% notched in 2007 or the roughly 10% in 2001. The executives and politicians who tripped over themselves to praise China’s model of development are noticeably quieter now.

Not every recession is like 2007, nor are they always accompanied by a financial collapse. The next slump, whenever it comes, will still be painful, so the U.S. might want to start casting about for an enthusiastic partner. It’s probably a mistake to expect that’ll be China this time around – it’s not only less willing, but less able.

U.S. recession indicators are growing stronger and there's one bigger-than-usual reason why the world should be worried: China isn't coming to the rescue this time.

In the past week alone, a gauge of U.S. manufacturing unexpectedly fell to its weakest reading in a decade and payrolls at private companies grew less than forecast. Economists are starting to wonder whether the U.S. has approached so-called stall speed, the slowest pace of growth without careening into a recession. The International Monetary Fund, meanwhile, will likely downgrade global growth estimates this month.

One of the engines that drove a global economic recovery after the last two downdrafts in America – the relatively shallow one in 2001 and the catastrophe that began in 2007 – was China. As the financial crisis escalated, Beijing opened a floodgate of credit and cut interest rates, which stoked demand for everything from Australian coal to German cars.

We’re unlikely to see anything like that this time. Beijing has shown little appetite for another round of massive fiscal stimulus as it atones for the profligacy of the last decade, which left a massive buildup of debt and fueled asset bubbles.

While Chinese authorities have been juicing the economy the past year, they have been very careful about how they go about it. Economists keep predicting cuts in the benchmark interest rate; but those haven't been forthcoming, as my Bloomberg Opinion colleague Shuli Ren wrote recently. The People's Bank of China has preferred trims to lenders' reserve requirements, as officials focus on the best way to channel credit to certain sectors of the business world. Open-slather easing, it isn’t.

Getting All Nostalgic

China's growth is dramatically slower these days

Source: National Bureau of Statistics

That doesn't augur particularly well for the prospects of a global recovery. The financial crisis saw the world's most consequential central banks coordinate rate cuts, with China's participation. Beijing’s involvement made China a serious player in the global monetary order.

How likely is it that the PBOC will happily sign off on something with the Fed once again? With President Donald Trump sitting in the White House, not very. Then again, Trump has already likened Federal Reserve Chairman Jerome Powell to Chinese President Xi Jinping. Desperation has been known to make odd bedfellows in pursuit of shared short-term goals.

The good news is that any steps China does take will have ripple effects given its sheer size. Gross domestic product is now about $14 trillion, compared with barely more than $1 trillion in 2001 and about $4 trillion in 2007. Chinese firms continue to plow investment into neighboring countries and Beijing-funded lenders like the Asian Infrastructure Investment Bank may well step up to provide cash to struggling economies.

Let's keep things in perspective, though. China is now recording quarterly economic growth of about 6%, not the 15% notched in 2007 or the roughly 10% in 2001. The executives and politicians who tripped over themselves to praise China’s model of development are noticeably quieter now.

Not every recession is like 2007, nor are they always accompanied by a financial collapse. The next slump, whenever it comes, will still be painful, so the U.S. might want to start casting about for an enthusiastic partner. It’s probably a mistake to expect that’ll be China this time around – it’s not only less willing, but less able.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| N | RBI Puts Currency Trading on Hold | Futures | 0 | |

| D | Platforms and languages for automated trading | Algo & Automated Trading | 2 | |

| R | What are best trading indicators? | General Trading & Investing Chat | 5 | |

| H | can we make our own trading platform | Software | 2 | |

| N | Tradingview Competition | General Trading & Investing Chat | 0 |

Similar threads

-

-

Platforms and languages for automated trading

- Started by Dynamo2000

- Replies: 2

-

-

-