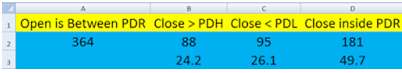

In this thread I will post some market studies which I do every now and then. These are on the Nifty index.

Here is the first one - If the open is inside the previous day's range then where is the close?

Three things can happen here

- Close is above the previous day's high

- Close is below the previous day's low

- Close is again between the previous day's range.

I wanted to check on this and ran some test on the EOD data from 2014 till date. Below is the result:

Out of 364 occasions, 49.7% of the time the close was again within previous day's range!!