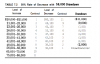

In Table 7.2 in page 101, he could buy 7 contracts with 60,100 but according to the formula given on preceding page, with this money level he must buy 8 contracts??

When increasing:

new level = current level + contracts*delta

once our equity grows above 'new level' we reinvest the profits to buy one more contract. This is 100% rate of increase.

In drawdown, as per authors example, we end up having 11 contracts with equity value of 80,100

if it were 100% rate of decrease the next level where we would cut our contracts to 10 will be

new level = current level - contracts* delta

i.e 69,100 = 80,100 - 11*1000

since we want to protect our profits foremost, instead of 100% decrease rate we choose 50% rate of decrease or

cut 2 contracts instead of 1 when we reach the level 69,100

after reaching 69,100 we end up with 9 contracts.

if the drawdown continues, our next level to cut size will be:

60,100 = 69,100 - 9*1000

just as explained before instead of cutting one position , we cut down 2 positions, reducing to 7 contracts !

---------

so far so good, in the next step author cuts down to 6 contracts, which he could have very well cut to 4, I think he is slightly being arbitrary here, and continues to cut 2 contracts in the next steps...

====

In this process of faster downsizing our position in bad times (just like Software companies!) we stand a chance to protect our profits.

once good times return, author explains about switch back to normal schedule of increase, while switching back to normal schedule we may need to jump from 5 to 9 contracts which is 'okay' and 'necessary' to regain the losses caused by 'previous large positions (i.e 11 contracts)' during draw down.

Hope that helps.

This is my understanding, I hope I have not misunderstood the author's idea !!!!