I can help you with stock chart reading

- Thread starter vvonteru

- Start date

- Status

- Not open for further replies.

Hi vvonteru,

I read this thread for the first time today and was very impressed by your very lucid analyses about various stocks and your trading strategy. In the market correction in the last 2 days, I have got stopped out of ITC, Hindalco, GE Shipping, SSI, ICICI Bank, Rolta, and Wockhardt. I had been holding these for about 3 to 4 months each as the trend in each case was up. At what levels do you suggest that I should re-enter? The trend still seems to be up. Also please explain with a chart example on any one of the above.

My best regards and please keep up your very sincere and honest effort for us novice traders.

I read this thread for the first time today and was very impressed by your very lucid analyses about various stocks and your trading strategy. In the market correction in the last 2 days, I have got stopped out of ITC, Hindalco, GE Shipping, SSI, ICICI Bank, Rolta, and Wockhardt. I had been holding these for about 3 to 4 months each as the trend in each case was up. At what levels do you suggest that I should re-enter? The trend still seems to be up. Also please explain with a chart example on any one of the above.

My best regards and please keep up your very sincere and honest effort for us novice traders.

Before I put in my comments, I like to thank you guys for your wonderful comments. I have never acknowledged this before. But, your comments did encourage me. And I did respond giving you guys what I know. I have so far given my Methodologies and Money Management techniques. The remaining would be my experience. We have already passed the 100 reply mark. Thanks again.

suggest me a site or help me out with all T.A techniques

--- I have already suggested some books. If you are serious, get them by any means. Books are better than on line info. Because, they go in orderly fashion. The style is good that you wouldn't get bored. If you insist, I have mentioned to use only Price, EMA, Volume, MACD, Williams indicators. Just read them on line in investopedia.com.

sudden increase in vol at particular price ,intraday.

--- Stocks behave like us. Why? because WE operate them. An WE are made up of same stuff and think a like for most of the cases. So, when we put a stop, WE all tend to put it at same point. Same for buy, sell decisions. As a result, there are lot of orders waiting to be executed at a same point. As a result, you will see lot of volatility with high volume at some price points. For EOD traders, when you put a stop, place couple of points high/low than what you think should be to avoid being stopped out.

--- Other scenario is, when you place stops, the market makers can see them. For low volume stocks, then can manipulate for a moment and hit your stop and come back (it will if there is no demand at the point). That is the reason you will see this huge bars in daily charts.

--- Another scenario is gapping down at the beginning of the day. If you carry stops overnight to next day, the market makers in the early morning gap the stock down, hit your stop. Since, there is no demand at the stop point, the stock goes back to previous day's trading region.

--- Having said the above, don't get paranoid from EOD trading stand point of view. It would be great if you don't carry stops overnight. Specially, if the stop is close to the current price. If the stop is far, it will be hard to manipulate. If you don't have time to do it, that should be fine too. The chances of occuring are low that you can disregard.

--- For day trading perspective, disregard volume info. You cannot do anything with volume in a day. Understand this. With all the TA, we are trying to read crowd behaviour on an average basis. You cannot make a valid judgement based on spike in volume in intraday. So, leave the volume info.

Also, yr comments reg Bse stocks,ICSA(531524) & Ankur drugs,both from investment point of view & intra day trading.

---ICSA, couldn't take out previous resistance at 750. So, should wait for it move up above this point.

---Ankur drugs, its been trading range between 120 and 160 for more than a year. Avoid.

---For intra basis, I will pass for now. Look for stocks having min. average volumes 3,00,000. More the volume the better.

stopped out of ITC, Hindalco, GE Shipping, SSI, ICICI Bank, Rolta, and Wockhardt.......At what levels do you suggest that I should re-enter?

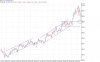

---We have to wait for the market to improve. Individual stocks improvement will come automatically. Right now all the stocks are breaking down. I will attach ITC chart.

For Day Traders:

--- Practice acquiring high Will Power. The crowd pull will be very high. The magnetic force is 100 times more than for EOD traders.

--- Don't count the money. Count the no. of times you used the methodology (crossover) to enter. Try to get this 100%. Money will flow as an after thought.

suggest me a site or help me out with all T.A techniques

--- I have already suggested some books. If you are serious, get them by any means. Books are better than on line info. Because, they go in orderly fashion. The style is good that you wouldn't get bored. If you insist, I have mentioned to use only Price, EMA, Volume, MACD, Williams indicators. Just read them on line in investopedia.com.

sudden increase in vol at particular price ,intraday.

--- Stocks behave like us. Why? because WE operate them. An WE are made up of same stuff and think a like for most of the cases. So, when we put a stop, WE all tend to put it at same point. Same for buy, sell decisions. As a result, there are lot of orders waiting to be executed at a same point. As a result, you will see lot of volatility with high volume at some price points. For EOD traders, when you put a stop, place couple of points high/low than what you think should be to avoid being stopped out.

--- Other scenario is, when you place stops, the market makers can see them. For low volume stocks, then can manipulate for a moment and hit your stop and come back (it will if there is no demand at the point). That is the reason you will see this huge bars in daily charts.

--- Another scenario is gapping down at the beginning of the day. If you carry stops overnight to next day, the market makers in the early morning gap the stock down, hit your stop. Since, there is no demand at the stop point, the stock goes back to previous day's trading region.

--- Having said the above, don't get paranoid from EOD trading stand point of view. It would be great if you don't carry stops overnight. Specially, if the stop is close to the current price. If the stop is far, it will be hard to manipulate. If you don't have time to do it, that should be fine too. The chances of occuring are low that you can disregard.

--- For day trading perspective, disregard volume info. You cannot do anything with volume in a day. Understand this. With all the TA, we are trying to read crowd behaviour on an average basis. You cannot make a valid judgement based on spike in volume in intraday. So, leave the volume info.

Also, yr comments reg Bse stocks,ICSA(531524) & Ankur drugs,both from investment point of view & intra day trading.

---ICSA, couldn't take out previous resistance at 750. So, should wait for it move up above this point.

---Ankur drugs, its been trading range between 120 and 160 for more than a year. Avoid.

---For intra basis, I will pass for now. Look for stocks having min. average volumes 3,00,000. More the volume the better.

stopped out of ITC, Hindalco, GE Shipping, SSI, ICICI Bank, Rolta, and Wockhardt.......At what levels do you suggest that I should re-enter?

---We have to wait for the market to improve. Individual stocks improvement will come automatically. Right now all the stocks are breaking down. I will attach ITC chart.

For Day Traders:

--- Practice acquiring high Will Power. The crowd pull will be very high. The magnetic force is 100 times more than for EOD traders.

--- Don't count the money. Count the no. of times you used the methodology (crossover) to enter. Try to get this 100%. Money will flow as an after thought.

Attachments

-

67.4 KB Views: 157

hi vvonteru,

i hv been wathing your thread with lot of interest. all your posts are educative and the way of your presentation of the concept is unique.

now i need a clarification on your post # 116.

quote:

Look for stocks having min. average volumes 3,00,000. More the volume the better.

:unquote

are the average volumes referred are daily average volumes? if so, there are only about 200 stocks meeting the specified volume criteria at NSE out of about 800 traded stocks!

thanks in advance.

murthymsr

i hv been wathing your thread with lot of interest. all your posts are educative and the way of your presentation of the concept is unique.

now i need a clarification on your post # 116.

quote:

Look for stocks having min. average volumes 3,00,000. More the volume the better.

:unquote

are the average volumes referred are daily average volumes? if so, there are only about 200 stocks meeting the specified volume criteria at NSE out of about 800 traded stocks!

thanks in advance.

murthymsr

hello vvonteru ,

we have all joined this amazing site for racking in the experience we haqve and make real money .

But after going thru ur posts and the insight u r providig i must admit i m impressed by your understanding of the stocks game .

I wish u keep on sharing wonderful ideas with us and keep enriching the traderji community .

All the best and thank u for the wonderful and enlightning effort .

we have all joined this amazing site for racking in the experience we haqve and make real money .

But after going thru ur posts and the insight u r providig i must admit i m impressed by your understanding of the stocks game .

I wish u keep on sharing wonderful ideas with us and keep enriching the traderji community .

All the best and thank u for the wonderful and enlightning effort .

Again, thanks for the encouragment. I am planning to do this as time permits and you require my help. What if you guys learnt enough from me and don't need me? In the mean time, read about shorting. Hopefully, we may not need this for some time. But, U never know.

In the mean time, read about shorting. Hopefully, we may not need this for some time. But, U never know.

what do you think about Infosys now that the results are out and bonus announced? What are the probable scenarios?...

---Our basis is TA. So, disregard the news for all purposes. Are U saying why?

1. The news is already discounted in most cases. We are at the end of the food chain. Before we know, so many people already know about it. The rupee value of the news at the point we know is negligible.

2. Have you ever observed the stock movement opposite to the news. The stock goes down inspite of good news. The stock goes up when the news is bad. This is because of expectations or for unknown reasons. But, observe this. The movement in most cases happen in the direction of the trend.

So, the lesson is, don't use news as the reason for trading signals. You signals should be entirely based on your methodology. No exceptions. Even if you know U can make money easily if U can make 1 time exception. U should not.

Money (greed) should not drive your signals. Your methodology should. This is required for your long term survival. U should come into this market thinking that U will be there for long time to come. You should accumulate money slowly. Do you know how many get busted in the 1st year? Do you know why? Greed!!!!!

what do you think about Infosys now that the results are out and bonus announced? What are the probable scenarios?...

---Our basis is TA. So, disregard the news for all purposes. Are U saying why?

1. The news is already discounted in most cases. We are at the end of the food chain. Before we know, so many people already know about it. The rupee value of the news at the point we know is negligible.

2. Have you ever observed the stock movement opposite to the news. The stock goes down inspite of good news. The stock goes up when the news is bad. This is because of expectations or for unknown reasons. But, observe this. The movement in most cases happen in the direction of the trend.

So, the lesson is, don't use news as the reason for trading signals. You signals should be entirely based on your methodology. No exceptions. Even if you know U can make money easily if U can make 1 time exception. U should not.

Money (greed) should not drive your signals. Your methodology should. This is required for your long term survival. U should come into this market thinking that U will be there for long time to come. You should accumulate money slowly. Do you know how many get busted in the 1st year? Do you know why? Greed!!!!!

Last edited:

Hi Vonteru,

As markets went down. Is it advisable to make a fresh entery into Infrastructure stocks.

1. Gammon India

2. Nagarjuna Constructions

3. Alstom Projects

4. Jaiprakash Associates

5. Nagarjuna Constructions

6. Patel Engineering

Let me know your picks and also some more good stocks in this sector.

Thanks,

Vijay

As markets went down. Is it advisable to make a fresh entery into Infrastructure stocks.

1. Gammon India

2. Nagarjuna Constructions

3. Alstom Projects

4. Jaiprakash Associates

5. Nagarjuna Constructions

6. Patel Engineering

Let me know your picks and also some more good stocks in this sector.

Thanks,

Vijay

- Status

- Not open for further replies.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| A | Please help me convert this indicator to metastock | MetaStock | 0 | |

| G | Need help to unlock Metastock exploration formula | MetaStock | 0 | |

| R | [pls help] technical chart for bse stocks | Technical Analysis | 8 | |

| V | Help each other..post u r stocks along with charts.. | Technical Analysis | 270 | |

| M | Help for aptistock and fcharts | Software | 6 |

Similar threads

-

-

-

-

Help each other..post u r stocks along with charts..

- Started by vsangeeth

- Replies: 270

-