COPPER POSITIONAL TARGET Rs.475

TECHNICAL VIEW :-

NOW COPPER FORMING INVERSE HEAD AND SHOULDER PATTERN,AS PER THIS PATTERN COPPER FACING STRONG RESISTANCE NOW AT NECKLINE [ 396-400 ].ONCE IF TRADE AND HOLD ABOVE THIS LEVEL THEN WE MAY SEE COPPER BREAK-OUT TARGET Rs.475.00 [ TARGET TIME FRAME 30-36 DAYS ]

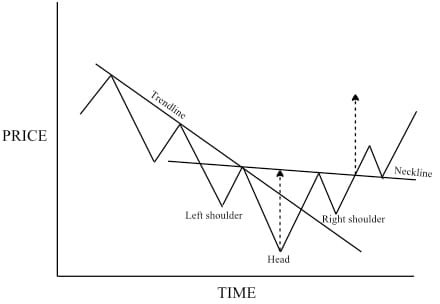

Inverse Head and Shoulders

The inverse head and shoulders occurs when a downtrend reverses into an uptrend, and is basically the head and shoulders pattern we have just analyzed turned upside down. As such, its really just a gradual change in the direction of the trend, marked by a penetrated trendline and weakening of the current trend.

Again, there are three points to the pattern, with the middle one, the head, being lower than the shoulders. The neckline is drawn across the two peaks between the low points, and its necessary for the price to rise clear of the neckline, otherwise it could just be a consolidation or sideways trend. The neckline is quite likely to slant downward, but does not have to for the pattern to be valid. If it slopes upward, then you will have to wait a little longer for it to be broken and to enter a long position, but it does indicate greater strength in the market.

You can set minimum price targets in a similar way to the head and shoulders topping pattern, looking for the price to exceed the neckline at least as far as it was below at the head. Again you should review previous support and resistance levels to see what other levels may apply.

The volume of trading is important in validating the pattern as an effective inverse head and shoulders. While the volume during downward price moves is not considered that important, you definitely want substantial volume when the price is moving up in a strengthening trend. The volume should increase rising up from the head, and perhaps be even stronger when the price breaks through the neckline. The final bull move must also show significant volume strength to confirm the power of the prices new direction.

Volume is more important with this pattern than with the head and shoulders topping pattern. Generally, when the price is going down you dont have to worry so much about volume, as the price can go down without much market action, but just from a lack of interest or demand. When prices are going up, the volume must be strong in order to make the price rise, and it shows that buyers are pushing it up. In other words, its a real and supported move.

TECHNICAL VIEW :-

NOW COPPER FORMING INVERSE HEAD AND SHOULDER PATTERN,AS PER THIS PATTERN COPPER FACING STRONG RESISTANCE NOW AT NECKLINE [ 396-400 ].ONCE IF TRADE AND HOLD ABOVE THIS LEVEL THEN WE MAY SEE COPPER BREAK-OUT TARGET Rs.475.00 [ TARGET TIME FRAME 30-36 DAYS ]

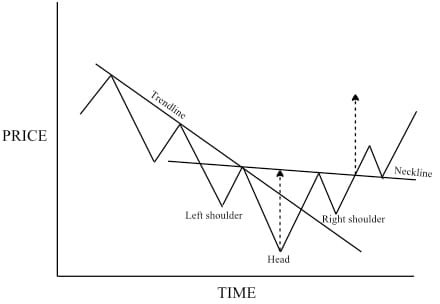

Inverse Head and Shoulders

The inverse head and shoulders occurs when a downtrend reverses into an uptrend, and is basically the head and shoulders pattern we have just analyzed turned upside down. As such, its really just a gradual change in the direction of the trend, marked by a penetrated trendline and weakening of the current trend.

Again, there are three points to the pattern, with the middle one, the head, being lower than the shoulders. The neckline is drawn across the two peaks between the low points, and its necessary for the price to rise clear of the neckline, otherwise it could just be a consolidation or sideways trend. The neckline is quite likely to slant downward, but does not have to for the pattern to be valid. If it slopes upward, then you will have to wait a little longer for it to be broken and to enter a long position, but it does indicate greater strength in the market.

You can set minimum price targets in a similar way to the head and shoulders topping pattern, looking for the price to exceed the neckline at least as far as it was below at the head. Again you should review previous support and resistance levels to see what other levels may apply.

The volume of trading is important in validating the pattern as an effective inverse head and shoulders. While the volume during downward price moves is not considered that important, you definitely want substantial volume when the price is moving up in a strengthening trend. The volume should increase rising up from the head, and perhaps be even stronger when the price breaks through the neckline. The final bull move must also show significant volume strength to confirm the power of the prices new direction.

Volume is more important with this pattern than with the head and shoulders topping pattern. Generally, when the price is going down you dont have to worry so much about volume, as the price can go down without much market action, but just from a lack of interest or demand. When prices are going up, the volume must be strong in order to make the price rise, and it shows that buyers are pushing it up. In other words, its a real and supported move.