Hi All,

I am trying to learn some F&O fundaas. If below question sounds funny or incorrect please correct it

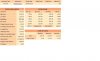

I have attached F&O quote of JP Assocaite.

At what price I will get 1 lot of JPassociate if I buy it

will it be 221.30+8.81(cost of carry) = 230.11*750(lot size)?

similary what will be sell price..

Please help to find it

Thanks

Sachin

I am trying to learn some F&O fundaas. If below question sounds funny or incorrect please correct it

I have attached F&O quote of JP Assocaite.

At what price I will get 1 lot of JPassociate if I buy it

will it be 221.30+8.81(cost of carry) = 230.11*750(lot size)?

similary what will be sell price..

Please help to find it

Thanks

Sachin

Attachments

-

57.9 KB Views: 42