Hey Neo,

Small piece of advice, don't be pennywise and pound foolish.. The first suggestion would be to think if it is really required to go to these discount brokers, would the savings offered be really that important for the way you trade.

A discount broker in the US removes all the offline services but provides you the best online trading platform. Presently, most of the guys you have mentioned offer NOW trading platform which is basically like this free engine being shared with everyone. Zerodha I guess is the only one that offers NEST hosted on their servers, but even that seems like 3 generations older than the present trading platforms offered by discount brokers in the US. You need to check out think or swim by TD ameritrade.. So ideally none of these are discount brokers in the true sense because they don't offer an awesome online platform.

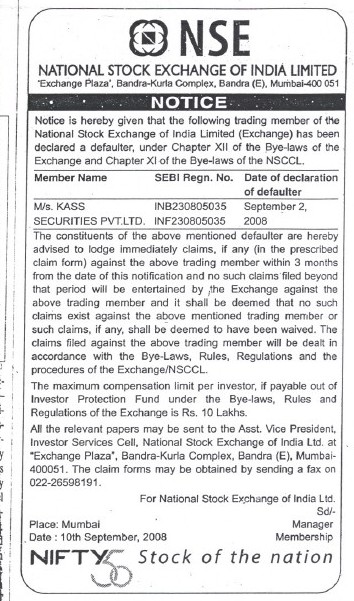

Finally the reason for my first quote was that, Delhi has the maximum number of defaulting brokers. Brokers who shut shop and disappeared with clients funds. NSE does a good job of hiding it, you can ask SEBI to give you this list. The reason I am telling you this is that if your broker doesn't make any money, are you not worried about him being in business or not? The reason you need to be worried is because your money is sitting with him and when he goes out of business, you know what happens... Think about it!!!

Small piece of advice, don't be pennywise and pound foolish.. The first suggestion would be to think if it is really required to go to these discount brokers, would the savings offered be really that important for the way you trade.

A discount broker in the US removes all the offline services but provides you the best online trading platform. Presently, most of the guys you have mentioned offer NOW trading platform which is basically like this free engine being shared with everyone. Zerodha I guess is the only one that offers NEST hosted on their servers, but even that seems like 3 generations older than the present trading platforms offered by discount brokers in the US. You need to check out think or swim by TD ameritrade.. So ideally none of these are discount brokers in the true sense because they don't offer an awesome online platform.

Finally the reason for my first quote was that, Delhi has the maximum number of defaulting brokers. Brokers who shut shop and disappeared with clients funds. NSE does a good job of hiding it, you can ask SEBI to give you this list. The reason I am telling you this is that if your broker doesn't make any money, are you not worried about him being in business or not? The reason you need to be worried is because your money is sitting with him and when he goes out of business, you know what happens... Think about it!!!

hi,

thanks for all the detailed info u provided for the most popular discount brokers.

One of the members "Creep" replied to this ...and i qoute"Finally the reason for my first quote was that, Delhi has the maximum number of defaulting brokers. Brokers who shut shop and disappeared with clients funds. NSE does a good job of hiding it"

Can u pls both guide me how to judge the reliability and credibility of all the brokers mentioned above??

Are all of them equally reliable or equally risky??

Or there can be some hidden things which we can focus on to find this out just like u mentioned the transaction charges and everything in detail ?

I m thinking of opening an account with 1 out of the 4 mentioned by u.(preferably vps share)

Kindly help.