Hi,

I'm a software engineer and a trader. I created a program to do backtesting on some ideas I had for trading the US Stock Market.

I would like to share some of my trading strategies with you (all my strategies use end of the day quotes freely available on many sites)

strategy Nr1

------------

this strategy has been working better with AAPL:

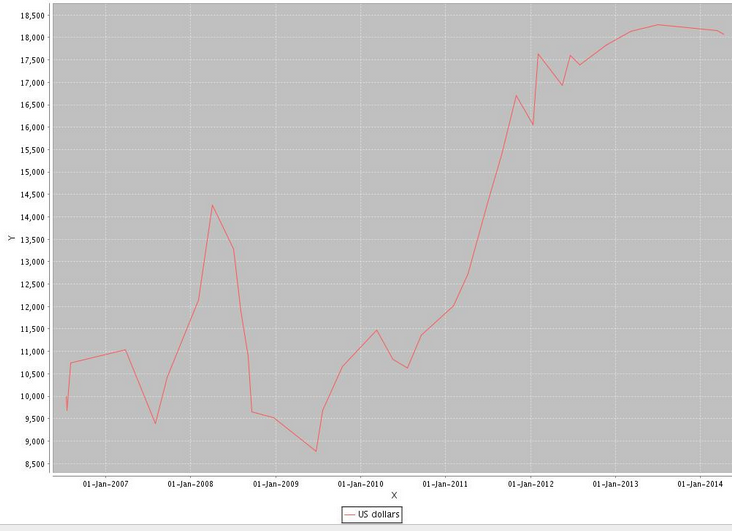

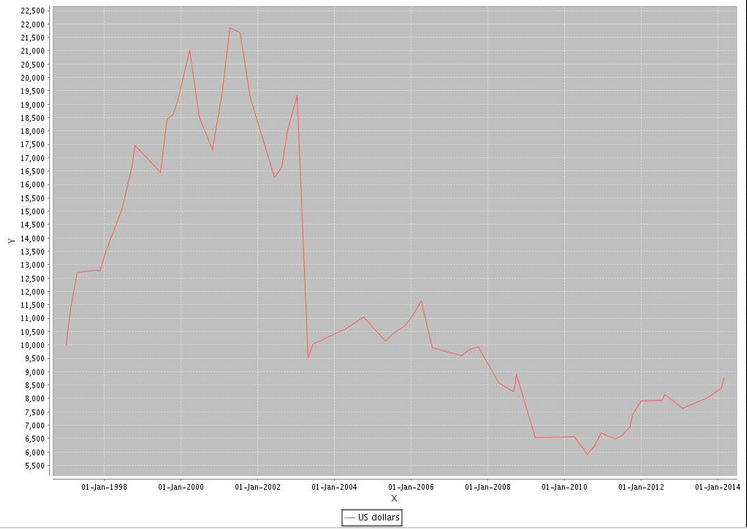

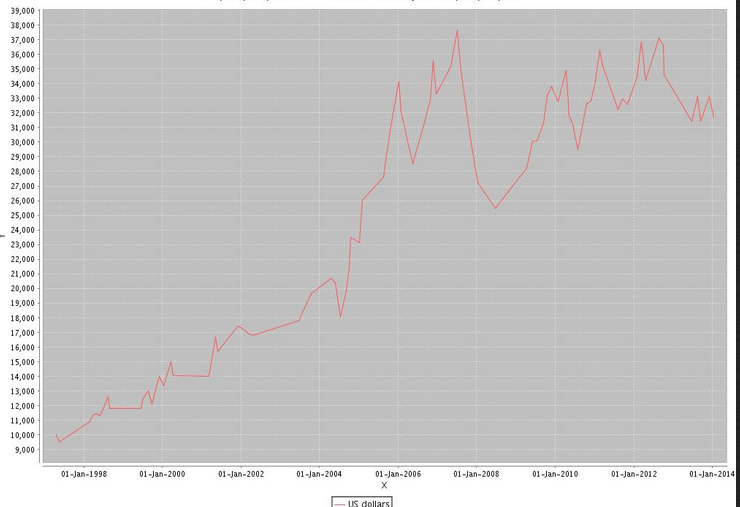

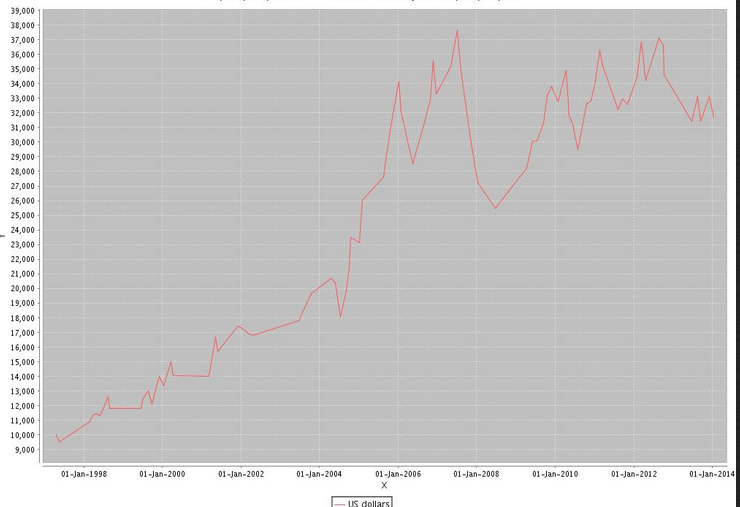

Equity curve (backtested from 01-January-1998 until yesterday. it makes 1 trade every two months on average)

some of the rules:

signal for buying:

- price is in value area (between SMA 10 & SMA 40)

- two consecutives higher close

- stockastic is in oversold area

exit signal:

- variable stop loss (to reduce losses)

- fixed take profits (when price reaches 4 times ATR = Average True Range)

I will try to post new trades as they are generated.

some facts I have realized while searching for a good trading method:

- trading strategies are not good all the time. there are some periods when they are more in tune with the market.

- trading strategies work better with some stocks.

- both "trend following" and "counter-trend" strategies can be successful, but don't follow them blindly. Choose the correct strategy depending If the market is in uptrend/downtrend, or trading sideways.

cheers and good luck on your trades :hap2:

I'm a software engineer and a trader. I created a program to do backtesting on some ideas I had for trading the US Stock Market.

I would like to share some of my trading strategies with you (all my strategies use end of the day quotes freely available on many sites)

strategy Nr1

------------

this strategy has been working better with AAPL:

Equity curve (backtested from 01-January-1998 until yesterday. it makes 1 trade every two months on average)

some of the rules:

signal for buying:

- price is in value area (between SMA 10 & SMA 40)

- two consecutives higher close

- stockastic is in oversold area

exit signal:

- variable stop loss (to reduce losses)

- fixed take profits (when price reaches 4 times ATR = Average True Range)

I will try to post new trades as they are generated.

some facts I have realized while searching for a good trading method:

- trading strategies are not good all the time. there are some periods when they are more in tune with the market.

- trading strategies work better with some stocks.

- both "trend following" and "counter-trend" strategies can be successful, but don't follow them blindly. Choose the correct strategy depending If the market is in uptrend/downtrend, or trading sideways.

cheers and good luck on your trades :hap2:

Last edited: