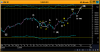

Re: Elliottwavecount for SENSEX

you would like to see my blog space on msn for further wave analysis for

sensex

http://spaces.msn.com/members/sensex-nifty/

you would like to see my blog space on msn for further wave analysis for

sensex

http://spaces.msn.com/members/sensex-nifty/