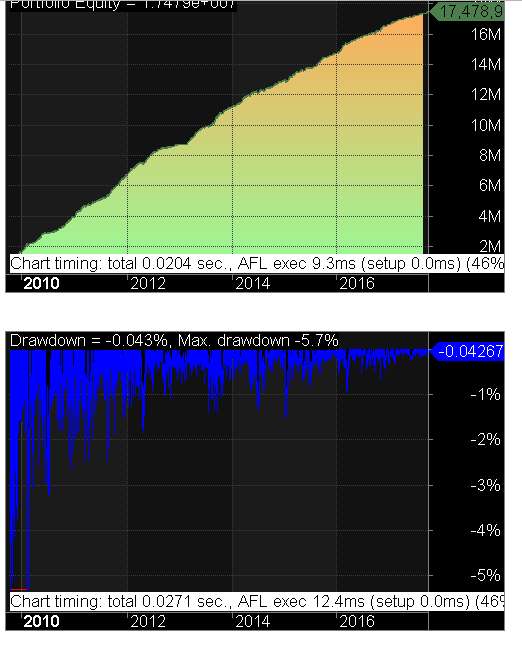

Backtested trading system

- Thread starter lemondew

- Start date

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Have you backtested the strategy that you are trading with | Derivatives | 14 | |

| M | my trading strategies - backtested | Trading Diary | 3 | |

| H | Backtested afl. | Advanced Trading Strategies | 0 | |

|

|

Does anybody have backtested VENGAI-2.Xls. | Software | 9 | |

| A | Swing Bank Nifty - With Backtested report ! | Futures | 184 |

Similar threads

-

Have you backtested the strategy that you are trading with

- Started by vagar11

- Replies: 14

-

-

-

-