Its a clarification regarding selection of reference setup for Countdown ("about 1.618 times thing"). http://www.traderji.com/technical-analysis/23286-thomas-demark-sequential-system-17.html#post209568

Posting this from one of posts of ST sir in previous DeMark thread:

"Now the rule is if the second set up length (pointwise distance travelled) is more than 1st set up but less than 1.618 of the first set up ,then ignore 1st set up and start countdown on 2nd set up.

If the length of 2nd set up is less than length of 1st set up or more than 1.618 of 1st set up then ignore second set up and continue the count down on 1st set up only" .

Posting this from one of posts of ST sir in previous DeMark thread:

"Now the rule is if the second set up length (pointwise distance travelled) is more than 1st set up but less than 1.618 of the first set up ,then ignore 1st set up and start countdown on 2nd set up.

If the length of 2nd set up is less than length of 1st set up or more than 1.618 of 1st set up then ignore second set up and continue the count down on 1st set up only" .

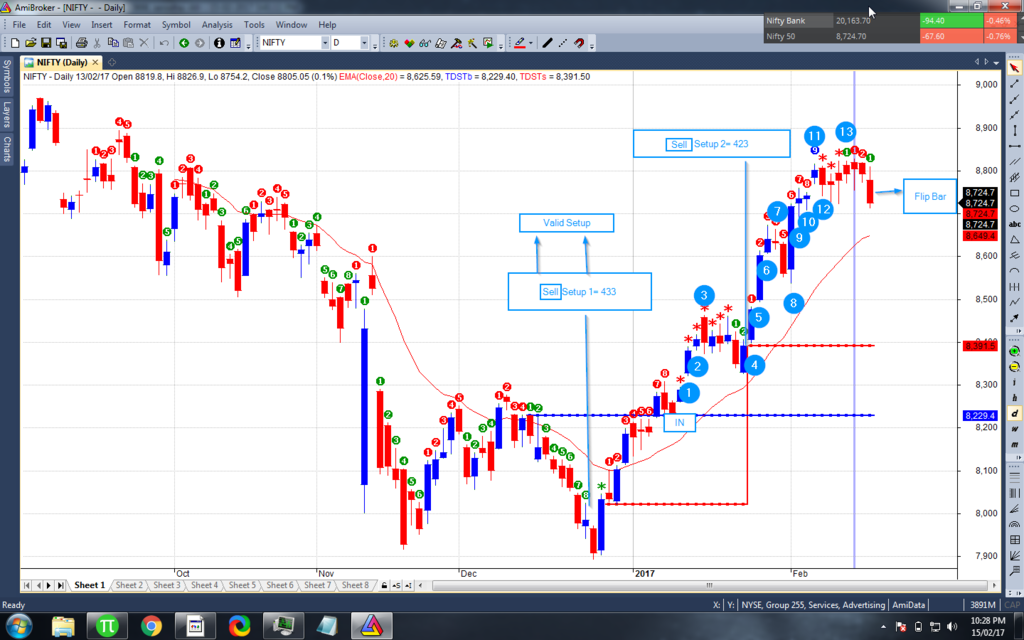

1st set up true low and true high was 8020.8 and 8461.05 respectively(1st setup extended to 17 bars).Range 440.15 pts.

2nd setup true low was 8480.95 and true high was 8821.4(2nd setup extended to 12bars).Range 340.45

2nd setup is less than 1st setup,hence 1st setup stands.